Will Bitcoin price reach $100,000 in 2024? Halving analysis & best brokers for trading it

Technical Forecasts for Bitcoin Price for 2024 and 2025

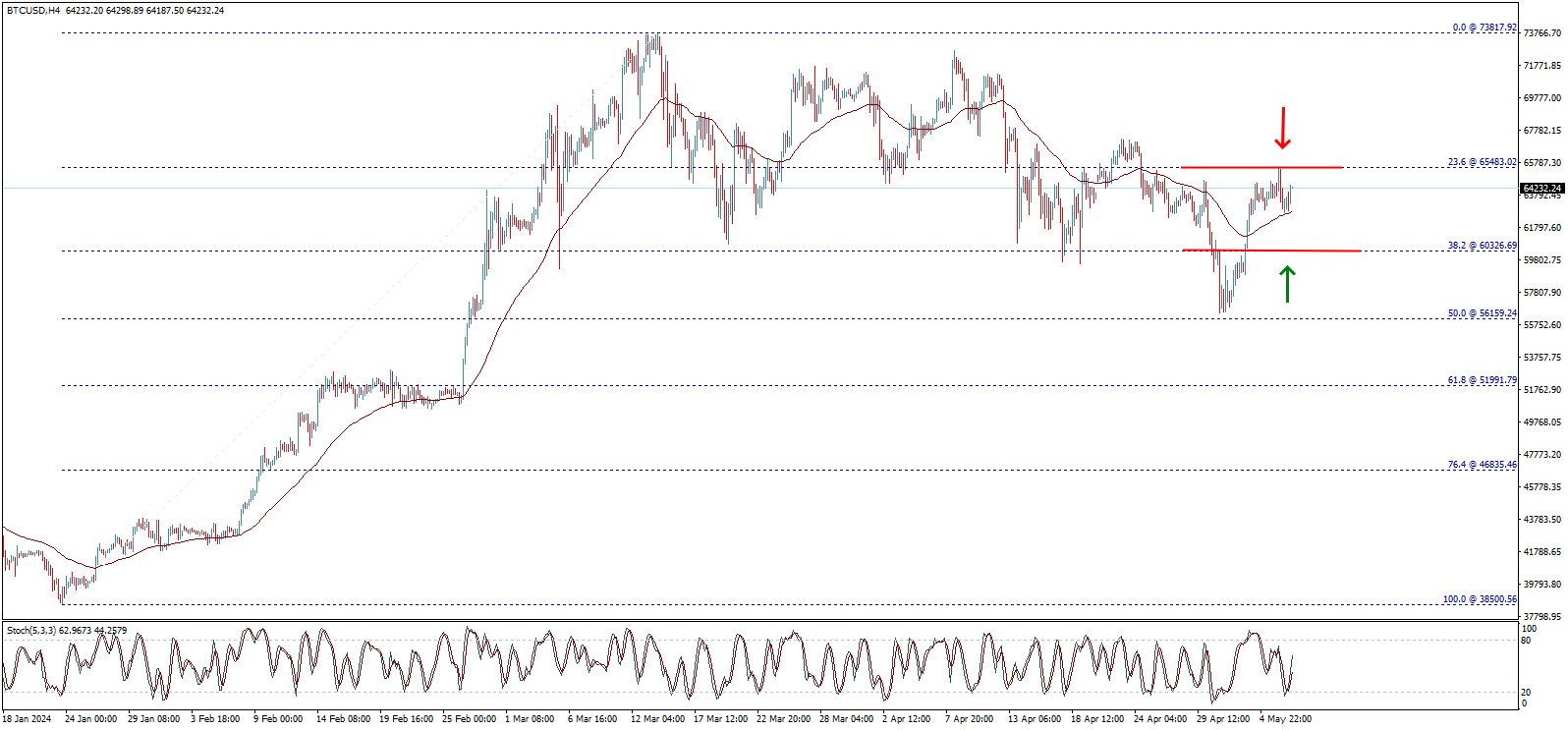

- As 2022 draws to a close, the price of Bitcoin begins to rise, showing signs of a long-term upward trend, anchored at $15,450.00 and climbing to record historical peak levels reached in mid-March of the current year, where the price reached $73,817.92, and from there began some downward correction that tested the 23.6% Fibonacci level at $60,039.77, after attempts to break it, it returns to try to recover and stabilize above it.

Best Bitcoin Trading Platforms for 2024 and 2025

Price transactions have recently stabilized around the Exponential Moving Average 50, and we note that the Stochastic indicator is losing positive momentum, which may press the price to attempt a decline again and undergo new downward corrections.

In the shorter term, we find that the price has undergone an additional bearish correction and approached the $56,000.00 barrier, but it collided with strong resistance areas around $65,480.00, presenting additional signals of a possible decline during the coming period.

Now, we are at an important crossroads for the price of Bitcoin, the parties of the conflict are represented by the support at $60,325.00 and the resistance at $65,480.00, and the price needs to exceed one of these levels to confirm the next direction more clearly.

- We point out that breaking the mentioned support will pressure the price to undergo an additional bearish correction reaching its next target at the $51,515.00 areas, while breaking through the resistance represents the key to the resumption of the overall upward course and achieving new gains starting with testing areas of $70,000.00 and then $73,815.00 primarily.

To determine the superiority of the next direction, we can look at the shorter time frames, to find that the price is drawing an inverted head and shoulders pattern shown in the following picture, the confirmation level of this pattern is located at $64,500.00, which means that breaking this level will push the price to launch upwards again and achieve positive goals that almost meet the targets of breaking the mentioned resistance, starting from $70,000.00 and reaching $72,500.00, to gain positive factors expected to contribute to pushing the price of Bitcoin to regain its health and the main upward path again.

In summary, the price of Bitcoin faces conflicting technical factors that may cause mixed and unclear trading initially, but there is a preference to resume the main upward trend after the downward correction recently conducted by the price, with the indication that confirming the resumption of the upward trend requires a confirmed breakout of the $65,000.00 level and stability with daily closures above it, and then surpassing the $70,000.00 barrier to add more confirmation to the resumption of the long-term upward trend and stop any chance for a new downward correction.

Conversely, it is necessary to pay attention to that breaking the $60,000.00 barrier and staying below it will put the price under new negative pressures starting with targeting the $56,000.00 areas and extending to $51,515.00 before any new attempt to recover.

Best Bitcoin Trading Company for 2024 and 2025

- Plus500, the best global trading company, trusted and licensed for Bitcoin trading.

- XM, the best reliable and suitable platform for beginners in Bitcoin trading.

Plus500 Company

| Licenses | FCA, CySEC, ASIC |

| Minimum Deposit | $100 |

| Trading Platforms | WebTrader, Windows 10, Mobile Apps |

| Assets Coverage | Forex, CFDs, Stocks, Commodities, Cryptocurrencies, Indices |

| Customer Support | 24/7 |

| Account Types | Regular, Professional |

Disadvantages

- User country restrictions

Advantages

- High-security trading platform

- User-friendly trading platform

- Licenses from several leading regulatory bodies worldwide

XM Company

| Licenses | CySEC, ASIC, IFSC |

| Minimum Deposit | $5 |

| Trading Platforms | MT4, MT5, WebTrader |

| Assets Coverage | Forex, CFDs, Stocks, Commodities, Cryptocurrencies, Indices |

| Customer Support | 24/7 |

| Account Types | Multiple, including Islamic accounts |

Disadvantages

- Cannot purchase Bitcoin outright

Advantages

- Educational materials for traders

- Easy deposit and withdrawal

- High security and transparency standards

- Helps traders develop strategies

Fundamental Analysis of Bitcoin Price for 2024 and 2025

In mid-March last year, Bitcoin prices succeeded in recording a new record level of approximately 74,000 US dollars, within an upward market that dominated the transactions of the digital asset. This was thanks to massive positive developments concerning the regulatory, technical, and fundamental framework for the world's largest cryptocurrency.

These developments include the continuous flows into the new instant investment funds, widespread purchases from major companies and institutions, and predictions of a supply shortage due to the halving event, in addition to the possibilities of cutting global interest rates, especially in the United States.

With the investment in the cryptocurrency "Bitcoin" moving to a more attractive environment, many global institutions and banks began to adjust their future expectations about the levels that the world's most important cryptocurrency can reach over the years 2024 and 2025.

The expectations have become more aggressive with the likelihood of reaching the important psychological barrier at 100,000 dollars per Bitcoin unit for the first time in history during the remaining period of this year, with even higher levels expected next year.

Brief Analyses and Predictions for Bitcoin Prices

- Bitcoin price predictions this week: After recording the highest level in two weeks above the $65,000 mark, some analysts expect the prices to continue rising until the important psychological barrier at $70,000.

- Bitcoin price predictions in May: It is likely that the world's most important digital currency will resume its monthly gains in May, after suffering a loss last April for the first time since August 2023.

- Bitcoin price predictions in 2024: With surpassing the record level near $74,000, the path is open for recording many historical levels, with the target being the important psychological barrier at $100,000.

- Bitcoin price predictions in 2025: In case of strongly surpassing the $100,000 barrier, the next targets for the cryptocurrency prices might be at $150,000 and then $200,000.

Billionaire Robert Kiyosaki Predicts Bitcoin Price to Reach 100,000 Dollars

In the latest predictions from the author of the famous book "Rich Dad Poor Dad," billionaire Robert Kiyosaki, he expected that the price of Bitcoin will reach 100,000 dollars by next June.

Kiyosaki has been a supporter of the digital currency Bitcoin for many years, and he often praised the digital asset, along with gold and silver, over "fake" paper currencies like the US dollar.

Kiyosaki said in a post on the "X" platform: that central banks are buying gold and not US bonds (debt). It is likely that gold will crash below the $1,200 level, which means a boom for silver and Bitcoin as well.

Instant Bitcoin ETFs Traded on American Exchanges

On Wednesday, January 10, 2024, for the first time, the US Securities and Exchange Commission "SEC" approved Exchange Traded Funds "ETFs" that invest directly in Bitcoin.

The regulatory authority in the United States granted permission to 11 funds to start official trading in the United States on Thursday, January 12, 2024, with the funds related to "BlackRock" and "Fidelity" at the forefront.

The Securities and Exchange Commission has opposed Bitcoin ETFs for more than a decade, while the cryptocurrency sector as a whole has faced harsh criticism from the head of the authority "Gary Gensler" who has argued repeatedly that the sector is rife with fraud and misconduct.

The Securities and Exchange Commission took strict actions against digital assets after the setback in 2022 and the bankruptcies such as the "FTX" exchange affiliated with Sam Bankman-Fried.

Dr. Campbell Harvey, a professor of finance at Duke University, said: that the approval of Bitcoin ETFs in the United States is an important moment in the short history of cryptocurrencies, as these assets move from specialized investment to mainstream investment.

Harvey added: Many investors will seek to diversify their investment portfolios by adding cryptocurrency investments through Bitcoin ETFs.

Leo Mizuhara, founder of asset management company DeFi Hashnot, said: Most of the money that moves immediately to Bitcoin ETFs will be reallocation operations.

Mizuhara added: The flow of new money into Bitcoin through the new ETFs will take some time.

These funds have seen large capital inflows, indicating the growing appetite of investors for digital assets.

Monthly Financial Flows to Bitcoin Funds

- January 2024: The first month of the launch of Bitcoin traded funds saw net inflows worth 1.46 billion US dollars. It was noted that the majority of these flows (723 million dollars) went to the "BlackRock" fund, the largest by volume.

- February 2024: The flows continued in a positive direction, totaling net inflows of 6.03 billion dollars. This brought the total fund flows to 7.49 billion dollars.

- March 2024: This month saw a decline in flows, amounting to 4.64 billion dollars. This brought the total fund flows to 12.13 billion dollars.

- April 2024: Flows declined for the first time since January, losing about 350 million dollars. This brought the total fund flows down to 11.78 billion dollars.

- May 2024 (so far): During the first week of May, Bitcoin traded funds saw a decline in net inflows by 220 million dollars. This brought the total fund flows down to 11.56 billion dollars.

Advantages of Bitcoin Traded Funds

Manuel Villegas, an economist at Julius Baer Bank, emphasized the advantages of the Exchange Traded Funds market, including lower implicit costs due to smaller spreads, less slippage, and reduced tracking errors.

It is worth mentioning that the spreads and slippage in Exchange Traded Funds are even lower than some centralized exchanges, offering significant benefits to investors.

Regulated Exchange Traded Funds allow investors to gain exposure to cryptocurrencies, bypassing the hassles of coin storage.

Huge Regulatory Approvals Support the Crypto Industry

After the approval to launch "Bitcoin" traded funds in the United States, regulatory approvals for financial assets related to cryptocurrencies continue to accumulate around the world.

In the United Kingdom, the London Stock Exchange said it would accept the issuance of bonds backed by Bitcoin and Ethereum currencies, and the Securities Regulation Authority in Thailand indicated that it would open cryptocurrency Exchange Traded Funds to individual buyers abroad.

With the approval of the Securities Regulation Authority in Hong Kong, on Tuesday, April 30, 2024, six instant Bitcoin traded funds began trading on the exchange.

Strong Bitcoin Purchases from Major Companies and Institutions

Since the beginning of the current year's transactions, major companies and institutions have increased their purchases of the cryptocurrency "Bitcoin" as a store of value, with MicroStrategy at the forefront of these institutions.

MicroStrategy Purchases

MicroStrategy, on Monday, February 26, 2024, revealed the purchase of 3,000 new units of Bitcoin, raising its holdings of the world's largest cryptocurrency to a value equivalent to about 10 billion US dollars. MicroStrategy, a leading enterprise software company in the field of information technology, adopts a bold investment strategy by purchasing Bitcoin as a fundamental part of its investment portfolio. The company's decision comes in response to recent shifts in global markets, where interest in the cryptocurrency "Bitcoin" as a means to diversify portfolios and protect value against economic fluctuations is increasing. MicroStrategy also revealed on Monday, March 11, 2024, about purchasing 12,000 new units of Bitcoin, raising its holdings of the world's largest cryptocurrency to 205,000 encrypted units, equivalent to a value of about 14 billion US dollars. The recent purchase is the second largest purchase made by the enterprise software manufacturing company since it began holding the cryptocurrency nearly four years ago. In the same context, the company announced in a statement issued on Wednesday, March 13, 2024, the issuance of unsecured convertible premium bonds worth 500 million dollars, due in 2031. The company aims from this issuance to collect new financial liquidity for the purpose of purchasing more cryptocurrency "Bitcoin" during the upcoming period, especially after the recent record rise in the currency's price.

What is Bitcoin Halving?

Bitcoin halving is an event that occurs every four years and leads to halving the mining reward. The network rewards this to compensate mining companies for validating transactions. As a result of the most recent halving last April, which is the fourth since 2012, the daily reward paid to miners will decrease to 450 "Bitcoin" from 900. According to most sources in the crypto industry, the new adjustment came into actual effect at 8:10 New York time on Friday, April 19, 2024.

Why Does Halving Protect "Bitcoin" from Global Inflation?

The change in rewards is intentional and predetermined by the code that operates the "blockchain" chain specific to the Bitcoin network. "Satoshi Nakamoto," the inventor of "Bitcoin," aimed to use the halving mechanism to maintain a final maximum limit of 21 million "Bitcoin" to protect the main cryptocurrency from global inflation.

Is Halving a Positive Incentive?

Some experts expect the halving to be a positive incentive for the latest bullish market because it further reduces the supply of new tokens at a time when demand for them has risen from the new Exchange Traded Funds that deal directly in the digital asset.

J.P. Morgan Predictions for Bitcoin Price After Halving

J.P. Morgan analysts wrote in a memo before the start of the halving event: Instead of focusing on the Bitcoin price, the main impact of this event will be reflected in the mining of the cryptocurrency.

Analysts at the global bank expect the mining sector to hold up, especially as struggling mining platforms exit, where publicly listed companies are in a better position to gain market share.

Deutsche Bank Predictions for Bitcoin Price After Halving

Similarly, Deutsche Bank analysts do not expect Bitcoin prices to rise significantly after the halving process ends. The analysts stated that since the Bitcoin algorithm had already anticipated the halving, the market had already taken this event into account.

Future Projections for Bitcoin Prices After Halving

- The CEO of Boom company "Alfred Adjei" said: The halving process preserves the rarity of the Bitcoin currency, thus increasing its unit value and ensuring the participation of miners until all Bitcoin coins are minted.

- Adjei predicted: Rising Bitcoin prices in the future until they reach a value of 104,000 US dollars by April 2025. He attributes this to the launch of Bitcoin and alternative currency Exchange Traded Funds in major regional stock markets across Europe, the Middle East, Africa, and Asia.

Global Monetary Easing Cycle

- Last March, the Swiss National Bank (SNB) unexpectedly reduced the standard interest rate to start a new monetary easing cycle. The Mexican central bank also reduced interest rates, and the Federal Reserve, the European Central Bank, and the Bank of England laid the foundation for what is called easing monetary policy in the coming months.

- Market experts say: In the medium term, there is clear optimism for stocks, residential real estate, gold, and Bitcoin, thanks to the global monetary easing cycle that will result in new liquidity being injected into the markets.

Important Price Milestones for the Cryptocurrency Bitcoin

- October 2011: Bitcoin price recorded the lowest level ever at 2 dollars per encrypted unit.

- March 2024: Bitcoin price recorded the highest level ever at 73,794 dollars per encrypted unit.

- November 2011: Bitcoin price recorded the lowest closing level ever at 3 dollars per encrypted unit.

- March 2024: Bitcoin price recorded the highest closing level ever at 73,121 dollars per encrypted unit.

Best Performance of Bitcoin Prices in History

- Year 2013: Best annual performance ever with a rise of 5,429%.

- Fourth quarter 2013: Best quarterly performance ever with a rise of 626%.

- November 2013: Best monthly performance ever with a rise of 450%.

Most Important Predictions About Bitcoin Prices in 2024

- "Grayscale," the largest investor in Bitcoin traded funds, predicts that the price of Bitcoin will reach 100,000 dollars per encrypted unit by the end of 2024, driven by increased demand from institutions and major investors.

- "Bloomberg" analysts predict that the Bitcoin price will reach 70,000 dollars by the end of 2024, thanks to the increasing integration of cryptocurrencies in global payment systems.

- "MicroStrategy," the leading investment company in the field of digital currencies, announced its bold predictions that the Bitcoin price will reach 600,000 dollars by 2026.

- "Binance," the largest digital platform in the world, predicts that Bitcoin prices will reach 76,500 dollars by the end of 2024.

- "Long Forext" analysts expect Bitcoin to continue rising rapidly in 2024, reaching 83,000 dollars by the end of the year.

- "ETC Group" expects the Bitcoin currency to slightly exceed the 100,000 dollar mark in 2024, due to the dwindling supply of the world's largest cryptocurrency in exchanges and long-term investment increases.

- "Standard Chartered" bank adjusted its Bitcoin price predictions from 100,000 to 120,000 by the end of 2024, thanks to the increasingly optimistic outlook for the potential of the Bitcoin market in the coming years.

Factors Affecting Bitcoin Price Predictions

- Institutional investment: The entry of major financial institutions into the cryptocurrency market is a key factor in driving the demand for Bitcoin, which may lead to price increases.

- Government regulation: The regulatory environment surrounding cryptocurrencies remains unclear, and new regulations could play a significant role in determining price trends.

- Market sentiment: Investor sentiment plays a key role in the movements of cryptocurrency prices, where fears or optimism can lead to significant price fluctuations.

- Macroeconomic performance: Macroeconomic factors, such as interest rates and economic growth, may affect investors' appetite for risk, which may be reflected in cryptocurrency prices.

- Technological developments: New technological developments in blockchain and digital currency technologies may improve their functions and adoption, potentially leading to price increases.

Frequently Asked Questions About Bitcoin

Is the Bitcoin price suitable for investment?

Bitcoin is currently trading around 65,000 dollars per encrypted unit. In light of most predictions indicating a bullish market for the world's largest cryptocurrency in 2024, we believe that levels between 65 and 60 thousand dollars are suitable for investment with the target above 100 thousand dollars.

How to invest in Bitcoin?

There are several different ways to invest in Bitcoin:

1. Immediate Bitcoin purchase: You can buy the cryptocurrency Bitcoin immediately from reliable digital currency trading platforms.

2. Mining: You can invest money in Bitcoin mining equipment and participate in the Bitcoin network to secure transactions and earn coins as a reward.

3. Long-term investment: You can hold Bitcoin for a long period and expect its price to rise over time.

4. Exchange Traded Funds (ETFs): Some financial markets offer Exchange Traded Funds linked to the performance of Bitcoin.

5. Global stocks: You can buy shares of companies associated with providing digital services and blockchain technology.

Will Bitcoin prices reach 100,000 dollars?

In light of recent developments in the digital asset market and other global markets, it is not entirely out of the question for Bitcoin prices to rise to 100,000 dollars this year, with this level being strongly surpassed in the coming years.

Is it expected that Bitcoin prices will rise in 2024?

Yes, it is expected that Bitcoin prices will continue to rise this year, as most predictions from institutions, major banks, and experts are stable around Bitcoin entering a bullish market with the approach of breaking the 74,000 dollars per encrypted unit barrier.

Cryptocurrency Technical Analysis

Cryptocurrency

Ethereum declines as markets process US inflation data

Most cryptocurrencies lost ground on Thursday as markets processed the latest US inflation data, ...

Cryptocurrency

Bitcoin slides ahead of Powell's remarks

Bitcoin lost over 2.5% on Tuesday, trending lower for the first time in four days amid risk ...

Cryptocurrency

Bitcoin climbs over 2.5% as the $60,000 barrier holds fast

Bitcoin rose over 2.5% on Monday, extending gains for the third straight session, as the important ...

Cryptocurrency Technical Analysis

Cryptocurrency

Ethereum price (ETHUSD) forecast update - 17-05-2024

Ethereum (ETHUSD) Price Analysis Expected Scenario Ethereum price (ETHUSD) rallies ...

Cryptocurrency

Bitcoin price (BTCUSD) forecast update - 17-05-2024

Bitcoin (BTCUSD) Price Analysis Expected Scenario Bitcoin price (BTCUSD) resumes its ...

Cryptocurrency

Ethereum price (ETHUSD) tests the support – Forecast today - 17-05-2024

Price Analysis for Ethereum (ETHUSD) Expected Scenario Ethereum price (ETHUSD) shows some ...